BTC Price Prediction: Analyzing the Path to $200K Amid Institutional Surge

#BTC

- Technical Strength: Price above key moving averages with Bollinger Band support indicating sustained upward momentum

- Institutional Demand: Major ETF inflows and corporate purchases creating strong buying pressure

- Market Sentiment: Analyst predictions of $135K-$200K targets and potential government adoption driving optimism

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

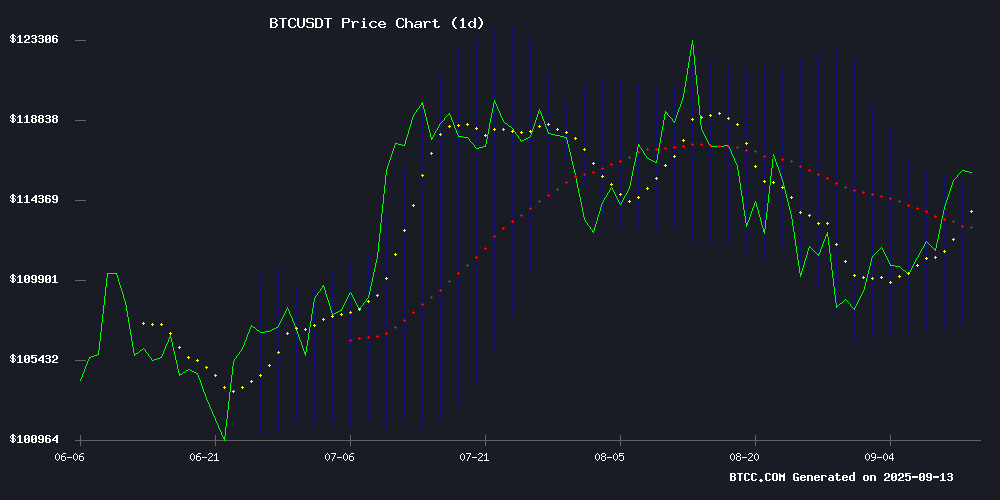

BTC is currently trading at $115,757.77, comfortably above its 20-day moving average of $111,544.25, indicating sustained bullish momentum. The MACD reading of -890.96 suggests some near-term consolidation, but the price position above the middle Bollinger Band at $111,544.25 reinforces the upward trend. According to BTCC financial analyst William, 'The technical setup suggests BTC is building a solid foundation for potential breakout moves, with the upper Bollinger Band at $116,015.25 acting as immediate resistance.'

Market Sentiment: Institutional Adoption and Whale Activity Fuel Optimism

Recent developments including Fidelity's $315 million Bitcoin purchase, ETF inflows, and significant whale movements after 13 years of dormancy are creating strong bullish sentiment. Standard Chartered's $135,000 price target and predictions of a U.S. strategic Bitcoin reserve announcement are adding to the positive momentum. BTCC financial analyst William notes, 'The combination of institutional adoption, regulatory clarity through ETFs, and renewed whale activity suggests we're entering a new phase of market maturity that could drive prices significantly higher.'

Factors Influencing BTC's Price

Bitcoin Breaks $115K After Fidelity Buys $315M and ETFs Surge

Bitcoin surged past $115,000, driven by escalating institutional interest and record inflows into spot ETFs. Fidelity's $315 million purchase underscores growing confidence among traditional financial giants in Bitcoin's long-term value proposition.

U.S. spot Bitcoin ETFs are witnessing unprecedented demand, reflecting a broader shift toward crypto adoption by both retail and institutional investors. The market cap now stands at $2.31 trillion, with daily trading volume exceeding $51 billion.

Analyst Ash Crypto highlighted Fidelity's move as a watershed moment for institutional participation. The tweet—'WHALES ARE LOADING'—captures the bullish sentiment permeating the market.

Bitcoin Whale Moves $50M After 13 Years—Market Speculation Intensifies

A dormant Bitcoin wallet holding 444.81 BTC, acquired in 2012 when prices hovered near $12, has abruptly reactivated after 13 years. The whale transferred 137.03 BTC (worth ~$16M) while retaining a $50M position, igniting debates about long-term holder behavior.

This follows a pattern of historic whale movements, including July's seismic transfer of 80,000 BTC ($9B+) after 14 years of dormancy. Such transactions carry outsized market impact—1,000 BTC whales now control $116M+ positions at current $115,000 price levels.

"Timing is never accidental with these moves," observes Doug Colkitt, Crocodile Labs CEO and early blockchain architect. The reactivation wave coincides with Bitcoin's post-halving price discovery phase, suggesting strategic positioning rather than arbitrary trading.

Undervalued Altcoin SpacePay Aims to Simplify Crypto Payments for Merchants

London-based startup SpacePay is tackling the friction points of crypto payments by enabling businesses to accept digital currencies through existing card terminals. The solution supports 325+ wallets and instantly converts transactions to fiat, shielding merchants from volatility.

Traditional crypto payment systems often require expensive hardware upgrades and operational overhauls—a non-starter for most small businesses. SpacePay's plug-and-play approach leverages familiar infrastructure while eliminating settlement risk through real-time conversion.

Bitcoin Security Pitfalls: Lessons from a $1.6 Million Loss

Julian Figueroa, host of The Exit Manual, has lost 14 BTC over the past eight years—worth approximately $1.6 million today. His experience underscores a harsh truth: most Bitcoin buyers will repeat at least one of the critical security mistakes he made.

The first mistake? Attempting to time the market. Figueroa lost 4 BTC chasing short-term gains. "Nobody beats the market over time," he admits. "Buy and hold almost always outperforms trading."

Altcoins proved equally treacherous. Figueroa sacrificed another 2 BTC chasing projects he believed would outperform Bitcoin. They didn't. The allure of quick riches often blinds investors to Bitcoin's proven resilience.

Gemini Crypto Exchange IPO Surges 14% as Winklevoss Twins Bullish on $1M Bitcoin

Gemini Space Station, the cryptocurrency exchange founded by Tyler and Cameron Winklevoss, made a strong Nasdaq debut, with shares climbing 14% after raising $425 million in its initial public offering. Priced at $28 per share, the IPO valued the company at $3.3 billion, surpassing earlier estimates. The stock opened at $37.01, peaking at $45.89 intraday before settling at $32.

The New York-based exchange offers a range of crypto services, including spot trading, institutional custody, and a USD-backed stablecoin. Despite holding over $21 billion in assets, Gemini reported losses of $159 million in 2024 and $283 million in the first half of 2025.

Appearing on CNBC, the Winklevoss twins reinforced their long-term bullish stance on Bitcoin, calling it "gold 2.0" and predicting a potential $1 million price target. "Adoption remains in the first inning," said Tyler Winklevoss, underscoring their conviction in the asset's growth trajectory.

Bitcoin Liquidity Tightens on Binance, Signaling Potential Rally

Bitcoin is showing early signs of gearing up for another bullish run, with liquidity dynamics on Binance taking center stage. The world's largest crypto exchange is experiencing a notable imbalance between outflows and inflows—a shift that often precedes price momentum.

Analytics firm CryptoQuant reports dwindling BTC deposits (refill_30d) against steady withdrawals (drain_30d), creating supply constraints. This follows a mid-August equilibrium period after initial deposit spikes when BTC neared $120,000. Markets now watch whether this liquidity squeeze will catalyze upward movement as traders hold assets off-exchange.

Arthur Hayes Says Bitcoin Outshines Stocks and Gold, Predicts $200K Ahead

Bitcoin's recent sideways movement has sparked concerns among some investors, but BitMEX co-founder Arthur Hayes remains bullish. In an interview with Kyle Chasse, Hayes argued that Bitcoin continues to outperform traditional assets like stocks and gold over the long term, despite short-term fluctuations.

"Anyone who bought it two, three, five, or ten years ago is laughing," Hayes remarked, dismissing the notion that Bitcoin is lagging behind record-high equities and precious metals. He emphasized Bitcoin's unmatched track record as a hedge against currency debasement.

Hayes cautioned against speculative short-term thinking, noting that sustainable gains require patience. His $200,000 price prediction reflects confidence in Bitcoin's enduring value proposition amid global macroeconomic uncertainty.

Crypto Market Cap Reclaims $4.1T Amid ETF Surge

Institutional capital is flooding back into the crypto market, with spot Bitcoin ETFs recording $1.7 billion in net inflows this week—the highest in two months. Wednesday alone saw $800 million pour in, signaling a sharp resurgence of institutional interest.

Bitcoin's price climbed 4.5% to $115,000, riding the wave of ETF demand. The total crypto market capitalization breached the $4.1 trillion threshold, underscoring renewed confidence in digital assets.

The strong performance of regulated crypto products like spot Bitcoin ETFs highlights growing mainstream adoption. Market momentum suggests bullish sentiment is firmly entrenched.

Bitcoin Surges to $115,790 as Standard Chartered Predicts $135K BTC Target

Bitcoin trades at $115,790, marking a 0.66% gain, as it approaches resistance levels. Standard Chartered Bank forecasts a bullish target of $135,000 by month-end, driven by institutional ETF inflows and corporate adoption. The bank's optimistic outlook contrasts with regulatory headwinds from the Czech Republic, where a government mishandling of seized bitcoin assets has sparked public backlash.

Market sentiment remains mixed. While some analysts project a path to $145,000, machine learning models suggest a potential pullback to $101,500. Bitcoin's RSI at 58.49 indicates neutral momentum, leaving room for upside if institutional demand persists.

Galaxy Digital Head Predicts U.S. Strategic Bitcoin Reserve Announcement in 2025

Alex Thorn, head of research at Galaxy Digital, asserts a high probability that the U.S. government will establish a Strategic Bitcoin Reserve (SBR) by year-end. This move would signal Bitcoin's transition from speculative asset to national treasury holding, akin to gold reserves.

Legislative momentum has built since March 2025, with bipartisan support crystallizing around Bitcoin's role in monetary strategy. Thorn emphasizes the distinction between formal policy and informal commentary, noting recent Treasury discussions indicate concrete progress rather than theoretical speculation.

The potential SBR framework suggests institutional validation at the sovereign level, potentially triggering cascading adoption across global central banks. Market analysts anticipate such an announcement could structurally alter Bitcoin's volatility profile and liquidity dynamics.

Winklevoss Twins Predict $1 Million Bitcoin as Gemini Goes Public

The Winklevoss twins have reignited bullish sentiment in crypto markets with a $1 million Bitcoin price prediction during Gemini's Nasdaq debut. Shares of their crypto exchange opened at $28 under ticker GEMI, valuing the company at $4.4 billion—a watershed moment for the 2014-founded platform that pioneered institutional crypto services.

Bitcoin's current $116,000 trading price lends credence to their projection. The twins' thesis hinges on Bitcoin's fixed supply and accelerating institutional adoption positioning it as 'Gold 2.0'. Their track record as early Bitcoin evangelists—having recognized its potential when prices languished below $1,000—adds weight to their latest forecast.

Is BTC a good investment?

Based on current technical indicators and market developments, BTC presents a compelling investment opportunity. The price trading above key moving averages, combined with strong institutional adoption through ETF inflows and major corporate purchases, creates a favorable risk-reward scenario.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $115,757.77 | Bullish |

| 20-day MA | $111,544.25 | Support Level |

| Bollinger Middle | $111,544.25 | Key Support |

| Upper Bollinger | $116,015.25 | Resistance |

With analysts predicting targets reaching $135,000-$200,000 and potential U.S. strategic reserve announcements, the fundamental backdrop remains strongly positive for long-term investors.